Ever wondered what is bookkeeping virtual assistant is and how it can help your business run smoothly? A bookkeeping virtual assistant is a remote professional who manages your financial records, tracks expenses, prepares reports, and keeps your books organized, all without requiring an office presence.

They combine accounting knowledge with virtual assistance skills to help you stay financially organized and compliant. Whether you’re a small business owner or managing an eCommerce store, a bookkeeping VA can save you time, money, and stress.

In this guide, we’ll explain what a bookkeeping virtual assistant does, how they work remotely, and why hiring one could be one of the best decisions for your business.

What Does a Bookkeeping Virtual Assistant Do?

A bookkeeping virtual assistant handles all the financial tracking and reporting tasks that help keep your business in shape. Their main job is to make sure every transaction is recorded correctly and that you always know where your money is going.

Common tasks include:

- Recording daily income and expenses

- Managing invoices and receipts

- Reconciling bank statements

- Preparing balance sheets and financial reports

- Tracking overdue payments or accounts receivable

- Supporting tax preparation by organizing records

Unlike traditional in-house bookkeepers, a virtual assistant works remotely using cloud-based software such as QuickBooks, Xero, or FreshBooks. This allows them to access your data securely and provide real-time updates.

Why Businesses Hire a Bookkeeping Virtual Assistant

Outsourcing your bookkeeping is not just about saving money—it’s about improving accuracy, consistency, and peace of mind. Here’s why many business owners turn to virtual bookkeeping assistants:

1. Saves Time for Core Business Tasks

Time is money. When you outsource bookkeeping, you can focus on marketing, operations, and strategy instead of worrying about spreadsheets and receipts.

2. Reduces Overhead Costs

Hiring a full-time accountant means paying salaries, benefits, and office space. A virtual assistant is usually paid per hour or per project, which makes it much more affordable.

3. Ensures Financial Accuracy

Professional bookkeeping VAs use automation tools that reduce human error. You get consistent, accurate financial reports, which help you make smarter business decisions.

4. Provides Flexibility and Scalability

Need help only during tax season or busy months? A bookkeeping virtual assistant can work part-time or on demand, making it easy to scale services based on your needs.

How a Virtual Bookkeeping Assistant Works Remotely

Virtual bookkeepers use secure cloud platforms and collaboration tools to manage your finances efficiently, even from miles away.

Step-by-Step Process

| Step | Task | Tools Commonly Used |

| 1 | Set up an accounting system | QuickBooks, Xero, Wave |

| 2 | Record transactions daily | Expense tracking software |

| 3 | Reconcile bank and card statements | Bank feeds integration |

| 4 | Generate reports monthly | Excel, Google Sheets, Power BI |

| 5 | Communicate with the client | Slack, Zoom, Trello |

Everything is shared securely through encrypted software. Most assistants sign NDAs (non-disclosure agreements) to ensure your financial information remains private.

Which Businesses Benefit Most from Virtual Bookkeeping Assistants

Virtual bookkeeping isn’t just for large companies. In fact, it’s most beneficial for small businesses, startups, and e-commerce owners who need professional financial management but can’t justify hiring a full-time accountant.

Ideal Business Types

| Business Type | Why It Benefits |

| eCommerce Stores | Track online sales, refunds, and inventory efficiently |

| Freelancers | Organize invoices and payments without manual tracking |

| Small Agencies | Manage client billing and project budgets easily |

| Startups | Keep financial data organized during growth phases |

If you run a Shopify store or service-based business, having a virtual bookkeeping assistant ensures your cash flow stays steady while you focus on growth.

How to Choose the Right Bookkeeping Virtual Assistant

Choosing the right assistant requires more than finding someone who knows accounting, it’s about finding someone who understands your industry and tools.

1. Look for Experience in Your Niche

A bookkeeper familiar with your business model will already understand how to categorize expenses and prepare reports specific to your field.

2. Check Software Skills

Make sure they’re certified or experienced in tools like QuickBooks Online, Xero, or Wave Accounting.

3. Ask About Communication Practices

Since everything happens remotely, ensure your assistant provides regular updates and quick responses.

4. Compare Pricing Options

Different VAs offer different pricing models. To explore affordable plans that match your needs, visit VA4Growth’s pricing page.

How Much Does a Bookkeeping Virtual Assistant Cost?

The cost of hiring a bookkeeping virtual assistant depends on their experience, the complexity of tasks, and how many hours you need each month.

On average, rates range from $10 to $25 per hour, making it far more affordable than hiring a full-time in-house accountant. At VA4Growth, our pricing is very competitive and designed to fit businesses of all sizes.

You can visit our pricing page to explore flexible packages that match your budget, or simply message us to discuss your specific bookkeeping needs, we’re always happy to customize a plan that works best for you.

For flexible options and bundled services, check out VA4Growth’s services.

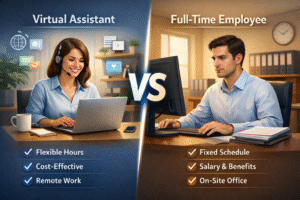

Advantages of Hiring a Virtual Bookkeeper Over an In-House Employee

Hiring a virtual bookkeeper offers several key advantages over having an in-house employee:

- Cost efficiency: A virtual bookkeeper is generally more affordable since you don’t need to cover benefits, equipment, or office space. In-house employees come with higher fixed costs.

- Flexibility: Virtual bookkeepers can scale their hours based on your workload, ideal for seasonal businesses or fluctuating needs, while in-house staff typically work fixed schedules.

- Accessibility: Because they work remotely, virtual bookkeepers can operate from anywhere and often provide support beyond standard office hours, giving you more coverage and convenience.

- Advanced tools: Most virtual bookkeepers use cloud-based accounting software that allows real-time collaboration and easy access to reports. In-house employees often rely on local systems that can limit flexibility.

- Data security: Cloud platforms used by virtual bookkeepers feature encryption and automatic backups, reducing risks compared to local storage systems that are more vulnerable to loss or damage.

Overall, a virtual bookkeeper provides a cost-effective, flexible, and secure way to manage your finances, delivering the same level of accuracy and professionalism as an in-house accountant without the added overhead.

Why Virtual Bookkeeping is the Future of Small Business Finance

Remote bookkeeping is becoming the new normal for small businesses. Automation, AI-driven analytics, and digital tools have made it easier than ever to manage finances without being tied to a desk.

This shift allows entrepreneurs to work smarter, not harder, keeping operations lean while maintaining full visibility over their financial health.

For related insights, read our guide on Virtual Personal Assistant Tasks and Services and discover how digital support roles can streamline your business further.

You can also explore how a Virtual Office Manager complements bookkeeping by managing day-to-day operations and workflow efficiency.

Practical Tips for Working With Your Bookkeeping VA

- Schedule regular check-ins to review reports and updates.

- Keep your documents organized using shared folders.

- Set clear expectations on deadlines and deliverables.

- Provide feedback regularly to maintain accuracy.

- Use automation tools to sync data between systems.

With good communication and trust, a virtual bookkeeping assistant can become one of your most valuable team members.

Hire Your Bookkeeping Virtual Assistant Today and Streamline Your Finances

A bookkeeping virtual assistant is your remote financial partner, handling daily transactions, organizing records, and generating reports so you can focus on growing your business. They offer accuracy, flexibility, and cost savings that traditional bookkeepers often can’t match.

By hiring a virtual assistant from a trusted source like VA4Growth, you gain not only financial expertise but also peace of mind knowing your books are in capable hands.

👉 Hire your bookkeeping VA today at VA4Growth and keep your finances stress-free.

Frequently Asked Questions

How do I find a reliable bookkeeping virtual assistant?

To find a trustworthy bookkeeping VA, look for proven experience, client reviews, and certifications in accounting tools like QuickBooks or Xero.

A reliable bookkeeping virtual assistant also communicates clearly and provides transparent reporting. Hiring from a reputable platform like VA4Growth ensures you work with vetted professionals who match your business needs.

How does a virtual bookkeeping assistant work remotely?

A virtual bookkeeping assistant works online using secure, cloud-based systems to track your financial data. They can access your records in real time, update transactions, and send reports through tools like Google Drive or QuickBooks.

Regular virtual meetings ensure accuracy and accountability, making remote collaboration seamless.

What Can a Virtual Assistant Bookkeeper Do?

A virtual assistant bookkeeper handles daily financial tasks such as data entry, expense tracking, invoice management, and preparing monthly reports. They help maintain accurate records for tax purposes and financial planning.

Their support ensures your books stay balanced, even when you’re too busy to manage them yourself.

Is bookkeeping hard for beginners?

Bookkeeping can be challenging for beginners without the right tools or training. However, a bookkeeping virtual assistant simplifies the process by managing everything for you.

They ensure your books remain accurate, deadlines are met, and you understand your financial position through clear reports.

What is virtual bookkeeping?

Virtual bookkeeping is the process of managing financial records online using digital tools. Instead of having an accountant in your office, you work with a remote professional who handles income, expenses, and reports securely in the cloud.

This makes it cost-effective, efficient, and ideal for businesses of all sizes.